This shop has been compensated by Collective Bias, Inc. and its advertiser, Walmart Family Mobile. All opinions are mine alone. #DataAndAMovie #CollectiveBias

Summer is just around the corner, which, for many people, means lots of fun – including a vacation, sports, picnics, and more! Of course in order to be able to do all of those things, a little bit of extra money helps. It is great if you already have money set aside for your big summer vacation or other activities, but if you don’t, how do you save it up? In our case, we are hoping to save up for a possible trip to Mexico to visit my family later this year. We haven’t been able to go for about three years, so it would be fun to see my family again. Unfortunately it costs a lot of money to fly down with 4 people, so we are trying to be creative with our savings.

In this post I want to talk about a few ways to save some money for all of your great Summer plans, without having to sacrifice your lifestyle very much.

1. Set Aside a Fixed Percentage of Your Tax Refund For Your Vacation Fund

We are always excited for this time of year because we usually get some sort of tax refund. This year will probably be one of the last years that we get a decent refund, so we are planning on saving as much as we can. Since we know how much we will be making from other sources throughout the year, we know how much we need to save. Sometimes it can be tempting to go out and spend it all on a new TV or something else, but when you are saving up for an expensive trip, and every penny counts, it is important to save what you can. We decided to set aside at least 50% of our tax refund for our vacation fund. We are saving some more for our emergency fund, and still have a little bit left for other expenses.

Saving can definitely be hard, but when you realize that you have enough for your trip or other activities, it will be worth it.

2. Switch to the Walmart Family Mobile PLUS plan for more Data and Extra Savings.

When we look at our monthly budget, it always hurts to see how much money we have to set aside for our cell phone plan. The worst part? We are paying a lot for a plan that doesn’t even let us use our phones as much as we need to! It is never fun to hit your data limit and have to suffer through slow internet until the next month begins.

The Walmart Family Mobile Plus plan is a new plan that features Unlimited Talk, Text, and Data, which includes up to 10GB of 4G LTE data per month per line for only $49.88 per month. This is a post-paid plan with no contracts, so you don’t have to worry about being locked in for long periods of time.

Another great bonus is that with this plan, you get 1 free movie on VUDU per line every month, which is a $7 value! This is great for us, because my husband and I are always looking for new movies and shows to watch at night before we go to bed. Sometimes we find ourselves scrolling through our tablet, looking for new shows to watch without any luck. With this new plan, we will always have at least two new movies to watch each month on our tablet.

Having the extra data is great too. My husband likes to work out in the morning by running or lifting weights, and he likes to listen to music while doing so. In the past he has run up against the data limits, so he has had to stop listening via mobile data half way through the month. This 10 GB of 4g LTE per month is more than enough, and will help us save money for our trip.

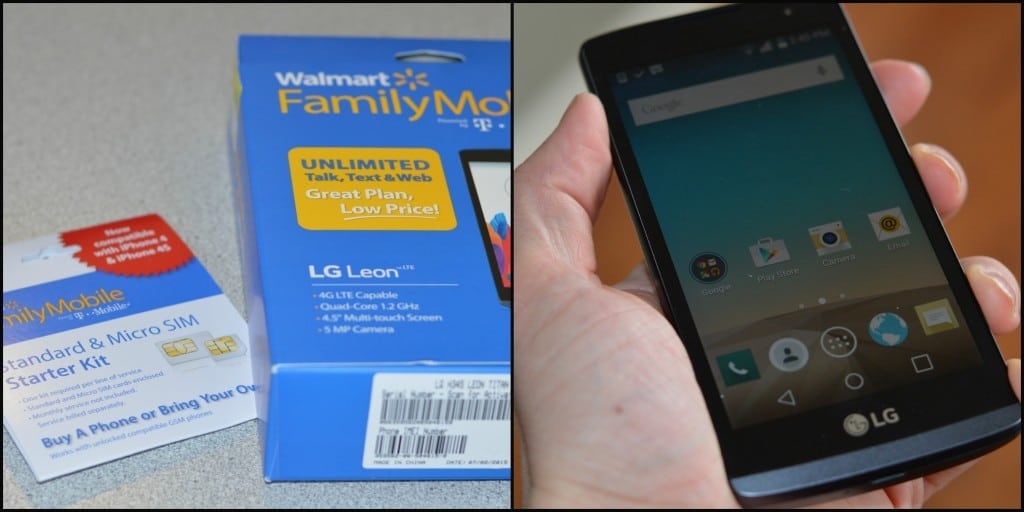

There are also some great phones that you can get for not a lot of money. If you have set some of your tax refund aside after saving for your vacation, you should have some left to buy one of these affordable phones. We went with the LG Leon LTE for $49.82, then we bought the Starter Kit for $25.00, and finally the plan for $49.88. So, in total we paid about $175 for one phone, one starter kit, and the first month of service on one line. Honestly, we are paying less with this plan, so the only real cost was the phone and the starter kit, and we are saving some money each month for our vacation. To sign up, just go to Walmart and find the phone and plan that works for you.

Disclaimer: All prices for phones and plans included in this post are accurate as of the date of posting; however, these prices are subject to change. Please refer to this information, or your local Walmart for current pricing.

3. Cancel Your Gym Membership

No. I am not saying that you should stop exercising. However, something that we are doing to cut back a little bit on our expenses is cancelling my husband’s gym membership. He set a goal last year to lose some weight, and, after reading this awesome book, his main source of exercise was running every morning. He was able to lose over 20 pounds, and has been working hard to keep it off. During the Winter it got harder to keep running because it was always cold and dark outside in the morning. Because of that, he signed up for a month to month membership at a local gym so that he could keep running and doing a little bit more during the Winter. Now that it is warming up, he says that he actually prefers running outside so we have decided to save the $30 per month that we were spending and put it towards our vacation budget. He is going to start running outside and using the free weights that we have at home as well!

This works well if you have a month to month plan, because when Winter comes you can always sign up again (his company has a corporate rate with no initiation fees). Of course you will have to look at your own situation, but this is working for us! Also, some gyms with long term contracts will allow you to “freeze” your membership for a few months rather than cancelling and charging a cancellation fee.

4. Plant a Garden to Save on Groceries

Anyone who has planted a garden knows that there is definitely some initial investment. However, if you do it right and get some good growth, you can end up saving a lot of money with all of the fruits and vegetables that you can produce.

Last year we tried a garden, but we were unable to keep it under control because of the large area where we had it, and because of the weeds. This year my husband decided that rather than trying to use the entire garden area, we would break it up into three separated elevated garden beds. If you buy these pre-made they can cost quite a bit. So, my husband decided to make his own and they are turning out great (tutorial on how to make these will be coming soon!).

We have high hopes of having a successful garden this year and that it will help us save even more.

5. Use Coupons and Coupon Apps to Save on Things you are Already Buying.

Over the past two years I have gotten really into using coupons to help out with our budget. I started out when my husband was in law school and and only working part time, and now that he has graduated and has a good job I still love using them to save extra money.

There are so many resources online that can help you determine where the good deals are and how to combine offers to multiply savings. One thing that has really helped is getting the Sunday newspaper, because it has coupons that you can then store, organize, and use as needed.

There are now multiple applications for your phone that you can use as well. The basic concept of all of the applications is that you buy the products, watch a short video or ad, and then it unlocks offers for you. You can then scan your receipt and the products and you get cash back! Some of these give you cash back on common purchases like milk, eggs, and bread. I have saved hundreds of dollars using these apps, and even more with the coupon savings. It can be overwhelming at first, but once you get the hang of it, it becomes second nature and you will see the savings add up. I will be writing a more in-depth article on this process very soon.

Conclusion

I know that this list is not long, and some of these options may not work for your particular situation. That said, there are many other way to save and the important thing is to have a plan. When you have an end goal and something that you are saving for, it makes it easier to stay motivated and to keep moving toward the goal. All of these ways to save should have a minimal impact on your lifestyle, but they really will help you save and before you know it you will be enjoying the beach, the mountains, a cruise, or any other fun vacation that you have planned.

What are some ways that you have been able to save? Let me know in the comments below!